Debt is Not a Bad Word: Funding New Jersey’s Infrastructure through Smart Financing

The following feature was originally published in the February 2025 edition of NJ Municipalities Magazine, which has been relied upon by local government leaders, department heads and administrators for over 100 years. NJ Municipalities is read by over 6,000 readers each month. You can read an online version, or view the pdf of the print edition.

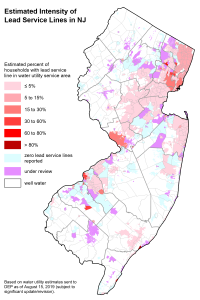

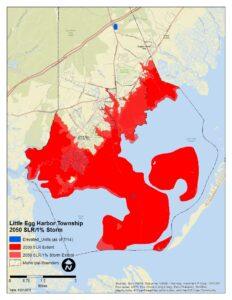

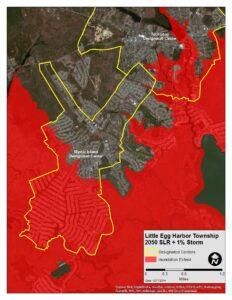

Municipalities face a tricky balancing act when it comes to infrastructure improvements: they need to address large, costly projects but have limited resources to fund them. Historically, issuing debt has been the primary means that municipalities are left with to finance critical improvements. However, municipal leaders are reluctant to be the ones responsible for issuing debt, while utilities and public systems are often hesitant to raise rates to cover project costs. The reluctance to take on debt is understandable, especially when debates over the federal debt ceiling and spending often dominate headlines. Concerns over affording the debt service, balancing the budget, raising enough revenues, and not wanting to burden taxpayers or ratepayers are valid. These issues span from the smallest municipalities to the federal government. By assisting municipalities and small-to medium-sized water systems in accessing funding for vital water infrastructure projects, New Jersey Future’s Funding Navigator program has come to appreciate these challenges. While grant programs and federal funding provide some relief, such as the Infrastructure Investment and Jobs Act (aka the Bipartisan Infrastructure Law) and the American Rescue Plan Act, these funds are limited and temporary. Programs like Clean Water and Drinking Water State Revolving Funds (SRFs) provide municipalities with more accessible options for financing critical infrastructure projects. The New Jersey Water Bank (NJWB), a partnership between the New Jersey Infrastructure Bank (I-Bank) and the New Jersey Department of Environmental Protection (NJDEP), offers low-interest loans to support clean water and drinking water infrastructure projects. In addition to the Water Bank, the I-Bank provides low-interest loans for other essential infrastructure through the Transportation Infrastructure Bank and the Resilience Infrastructure Bank. These funding sources are fundamental to addressing the state’s infrastructure needs. When paired with effective planning and sound financial management practices, they help mitigate the risks commonly associated with taking on debt. “If you set a plan and follow the plan, it helps you avoid an emergency. When you do things in an emergency, you pay more for it and can’t plan as efficiently,” explains Thomas Horn, Executive Director of the Lambertville Municipal Utilities Authority. Horn’s experience highlights the significant potential benefits of State Revolving Fund (SRF) low-interest loans. The municipality utilizes a 30-year infrastructure plan that allows it to anticipate water system needs well in advance. By leveraging low-interest loans from the I-Bank, they have made essential system upgrades while developing a fair and sustainable rate structure to manage the debt service. Lambertville’s proactive approach helps avoid the high costs and inefficiencies associated with emergency repairs. Horn also acknowledges a perspective shared by many municipal leaders: while no one likes taking on debt, sometimes it is necessary. “It’s like a mortgage,” he says. “Very few systems and towns have the resources to fund large infrastructure improvements outright.” Lambertville’s experience underscores the importance of long-term planning and strategic financing in maintaining critical infrastructure. Strong financial management practices can help municipalities, utilities, and taxpayers benefit from strategic debt use. For municipalities and utilities, debt provides enhanced project funding by facilitating large-scale infrastructure projects with access to capital markets with favorable interest rates, such as those offered by the Water Bank. As Lambertville has demonstrated, loans provide the financial resources needed for critical improvements without placing an immediate strain on existing funds, enabling municipalities to focus on strategic planning and implementation. This approach ensures that cash reserves are preserved for true emergencies, while a structured repayment schedule spreads costs over time, aligning debt service with the lifespan of the infrastructure. By reducing upfront costs, debt can accelerate project timelines, which is essential for addressing urgent needs. Even municipalities or utilities with sufficient cash reserves can benefit from debt. Low-interest loans are particularly advantageous when their rates are lower than the returns on cash reserves or fund balances, which can be saved for unexpected delays or misaligned payment schedules. Beyond financial stability, infrastructure improvements driven by strategic debt use make municipalities more competitive by attracting businesses and residents, ultimately strengthening the local economy and increasing ratables, which can help fund the debt service over time. Taxpayers and ratepayers can also benefit from this approach. Infrastructure investments generate jobs and economic stimulation during the planning and construction phases while offering long-term benefits like modernization and enhanced service reliability. Improved infrastructure leads to better service delivery and greater safety for utilities and water systems. Furthermore, debt payments distribute the cost of these improvements over their useful life, ensuring that future users contribute to funding and avoiding hefty, one-time tax or rate increases. Proper planning, as demonstrated by Lambertville, is critical for avoiding costly and disruptive emergencies and ensuring that communities’ financial and service needs are met effectively. The reality is that, much like the nation as a whole, New Jersey faces costly and urgent infrastructure challenges. According to the U.S. Environmental Protection Agency, addressing all the necessary improvements and repairs for drinking water and clean water infrastructure in New Jersey alone will require an estimated $31.6 billion. In 2021, the U.S. received a C- rating from the Report Card for America’s Infrastructure, while in 2016, New Jersey received a D+ rating, highlighting the dire need for investment. As a coastal state, New Jersey is particularly vulnerable to flooding and the impacts of climate change, making infrastructure improvements and resilience efforts more critical than ever. Debt is not a bad word—it is a vital tool that enables municipalities to address these challenges without overwhelming current resources when used strategically and with sound financial management. By leveraging debt effectively, New Jersey can build the resilient, modern infrastructure needed to support its communities and secure a sustainable future.

Related Blog

11/26/2025

08/12/2025

07/16/2025

07/15/2025

07/15/2025

07/01/2025

07/01/2025

07/01/2025

06/30/2025

06/30/2025

06/30/2025

06/26/2025

06/19/2025

06/19/2025

06/16/2025

05/21/2025

05/15/2025

04/22/2025

04/01/2025

03/14/2025

03/13/2025

02/18/2025

12/02/2024

09/19/2024

08/30/2024

07/30/2024

07/30/2024

07/30/2024

07/30/2024

07/30/2024

07/30/2024

06/24/2024

06/24/2024

03/29/2024

03/29/2024

03/19/2024

03/19/2024

03/15/2024

01/29/2024

01/12/2024

12/18/2023

12/05/2023

12/05/2023

11/30/2023

10/12/2023

09/20/2023

09/18/2023

08/08/2023

07/20/2023

07/20/2023

07/20/2023

07/20/2023

07/20/2023

07/18/2023

07/18/2023

07/18/2023

07/18/2023

07/18/2023

07/17/2023

07/17/2023

07/17/2023

06/06/2023

05/17/2023

05/17/2023

05/11/2023

03/17/2023

03/16/2023

02/06/2023

01/31/2023

01/30/2023

01/20/2023

01/17/2023

01/04/2023

05/01/2023

04/19/2023

04/17/2023

11/29/2022

11/11/2022

10/25/2022

10/21/2022

10/18/2022

09/22/2022

09/21/2022

08/16/2022

08/09/2022

07/19/2022

07/19/2022

07/11/2022

07/11/2022

07/11/2022

07/11/2022

07/11/2022

07/08/2022

07/08/2022

07/08/2022

07/08/2022

07/08/2022

07/08/2022

07/08/2022

07/07/2022

07/07/2022

06/30/2022

06/29/2022

06/27/2022

06/24/2022

06/22/2022

06/10/2022

05/23/2022

05/23/2022

05/20/2022

04/25/2022

03/24/2022

02/22/2022

02/18/2022

01/19/2022

12/07/2021

12/02/2021

11/01/2021

10/13/2021

10/13/2021

10/13/2021

09/13/2021

09/13/2021

09/13/2021

09/13/2021

07/19/2021

07/19/2021

07/19/2021

07/19/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/25/2021

06/24/2021

06/24/2021

06/24/2021

06/15/2021

06/15/2021

06/15/2021

05/06/2021

05/04/2021

04/30/2021

04/12/2021

04/12/2021

04/12/2021

03/15/2021

03/15/2021

03/15/2021

03/05/2021

02/15/2021

02/15/2021

02/11/2021

02/11/2021

02/10/2021

02/09/2021

01/15/2021

12/21/2020

08/06/2020

08/06/2020

07/14/2020

07/14/2020

07/14/2020

06/12/2020

05/26/2020

04/19/2020

03/11/2020

03/11/2020

03/02/2020

03/02/2020

02/17/2020

11/10/2020

11/10/2020

11/09/2020

11/09/2020

11/09/2020

10/14/2020

10/14/2020

10/14/2020

10/14/2020

09/16/2020

09/16/2020

09/15/2020

09/15/2020

09/04/2020

08/11/2020

08/06/2020

07/14/2020

07/14/2020

06/12/2020

06/12/2020

06/10/2020

06/05/2020

06/03/2020

05/26/2020

05/06/2020

05/05/2020

05/05/2020

04/15/2020

04/15/2020

04/09/2020

03/13/2020

03/11/2020

03/09/2020

02/20/2020

02/17/2020

01/16/2020

01/14/2020

01/13/2020

01/07/2020

09/04/2019

08/13/2019

05/06/2019

04/24/2019

03/22/2019

03/18/2019

03/13/2019

03/01/2019

03/01/2019

03/01/2019

02/26/2019

01/14/2019

01/02/2019

01/02/2019

12/17/2019

12/12/2019

12/11/2019

12/09/2019

11/11/2019

11/11/2019

11/06/2019

11/06/2019

10/25/2019

10/18/2019

10/17/2019

10/15/2019

10/14/2019

10/14/2019

10/11/2019

10/03/2019

09/25/2019

09/23/2019

09/09/2019

09/06/2019

09/06/2019

09/06/2019

09/05/2019

09/04/2019

09/04/2019

09/04/2019

09/03/2019

08/28/2019

08/28/2019

08/26/2019

08/19/2019

08/13/2019

08/13/2019

08/12/2019

08/12/2019

08/09/2019

08/09/2019

07/29/2019

07/19/2019

07/19/2019

07/19/2019

07/17/2019

07/17/2019

07/16/2019

07/16/2019

07/16/2019

07/10/2019

07/03/2019

06/24/2019

06/21/2019

06/21/2019

06/10/2019

06/10/2019

06/07/2019

06/07/2019

06/07/2019

06/03/2019

06/03/2019

06/03/2019

06/03/2019

05/23/2019

05/22/2019

05/21/2019

05/20/2019

05/20/2019

05/20/2019

05/17/2019

05/17/2019

05/13/2019

05/13/2019

05/10/2019

05/08/2019

05/08/2019

05/08/2019

05/08/2019

05/03/2019

05/03/2019

04/29/2019

04/29/2019

04/22/2019

04/22/2019

04/19/2019

04/17/2019

04/17/2019

04/10/2019

04/10/2019

04/10/2019

04/03/2019

04/03/2019

04/03/2019

03/29/2019

03/29/2019

03/29/2019

03/29/2019

03/29/2019

03/29/2019

03/29/2019

03/29/2019

03/29/2019

03/22/2019

03/22/2019

03/18/2019

03/15/2019

03/15/2019

03/04/2019

03/01/2019

03/01/2019

03/01/2019

03/01/2019

02/27/2019

02/27/2019

02/25/2019

02/25/2019

02/25/2019

02/25/2019

02/25/2019

02/25/2019

02/18/2019

02/18/2019

02/18/2019

02/18/2019

02/06/2019

02/04/2019

02/04/2019

02/01/2019

02/01/2019

01/31/2019

01/30/2019

01/29/2019

01/28/2019

01/28/2019

01/28/2019

01/25/2019

01/25/2019

01/25/2019

01/23/2019

01/18/2019

01/18/2019

01/18/2019

01/18/2019

01/16/2019

01/10/2019

01/10/2019

01/10/2019

01/09/2019

01/07/2019

01/04/2019

01/04/2019

01/04/2019

01/04/2019

01/04/2019

12/06/2018

12/03/2018

11/07/2018

11/05/2018

11/02/2018

10/25/2018

10/23/2018

10/23/2018

10/12/2018

10/08/2018

10/02/2018

09/25/2018

09/04/2018

08/17/2018

08/17/2018

08/13/2018

07/25/2018

07/24/2018

05/31/2018

05/25/2018

05/16/2018

05/03/2018

05/01/2018

05/01/2018

04/26/2018

04/18/2018

04/10/2018

04/04/2018

04/02/2018

03/30/2018

03/29/2018

03/27/2018

03/26/2018

03/20/2018

03/16/2018

02/06/2018

01/05/2018

01/04/2018

01/04/2018

12/18/2018

09/12/2018

07/19/2018

03/28/2018

12/20/2017

12/12/2017

12/06/2017

11/30/2017

11/27/2017

11/22/2017

11/17/2017

11/03/2017

10/25/2017

10/18/2017

09/28/2017

09/27/2017

09/19/2017

09/18/2017

08/31/2017

08/31/2017

08/14/2017

08/02/2017

07/24/2017

07/20/2017

07/14/2017

06/29/2017

06/28/2017

06/12/2017

05/26/2017

05/23/2017

05/05/2017

04/12/2017

04/11/2017

04/10/2017

04/05/2017

03/27/2017

03/23/2017

03/20/2017

03/20/2017

03/20/2017

03/17/2017

03/10/2017

02/21/2017

02/17/2017

02/16/2017

02/08/2017

02/08/2017

01/26/2017

01/24/2017

01/19/2017

01/19/2017

01/10/2017

01/10/2017

12/13/2017

12/06/2016

11/18/2016

11/16/2016

11/14/2016

11/08/2016

11/01/2016

10/20/2016

10/17/2016

10/12/2016

10/05/2016

09/28/2016

09/14/2016

08/22/2016

08/10/2016

07/28/2016

07/27/2016

07/13/2016

06/24/2016

06/23/2016

06/02/2016

06/02/2016

05/26/2016

05/25/2016

05/23/2016

05/20/2016

05/20/2016

05/18/2016

05/17/2016

05/16/2016

05/13/2016

05/04/2016

04/27/2016

04/19/2016

04/18/2016

04/11/2016

04/06/2016

04/04/2016

04/04/2016

03/28/2016

03/24/2016

03/23/2016

03/22/2016

03/17/2016

03/17/2016

03/15/2016

03/07/2016

02/23/2016

02/18/2016

02/18/2016

02/09/2016

02/05/2016

01/27/2016

01/26/2016

01/22/2016

01/19/2016

01/13/2016

01/07/2016

12/15/2015

12/15/2015

12/15/2015

12/08/2015

11/19/2015

11/10/2015

11/03/2015

10/28/2015

10/27/2015

10/26/2015

10/19/2015

10/06/2015

10/05/2015

09/24/2015

09/10/2015

09/01/2015

08/19/2015

08/14/2015

08/12/2015

08/04/2015

07/30/2015

07/27/2015

07/10/2015

07/10/2015

07/08/2015

07/01/2015

06/29/2015

06/22/2015

06/18/2015

06/15/2015

05/15/2015

05/13/2015

05/13/2015

05/05/2015

05/04/2015

04/28/2015

04/28/2015

04/22/2015

04/21/2015

04/13/2015

04/10/2015

04/10/2015

03/30/2015

03/26/2015

03/18/2015

03/18/2015

03/17/2015

03/12/2015

03/10/2015

02/27/2015

02/19/2015

02/18/2015

02/17/2015

02/06/2015

02/04/2015

02/02/2015

01/27/2015

01/23/2015

01/21/2015

01/20/2015

01/15/2015

01/15/2015

01/15/2015

01/06/2015

12/19/2014

12/12/2014

12/10/2014

12/05/2014

12/02/2014

11/19/2014

11/17/2014

11/10/2014

11/06/2014

11/06/2014

11/01/2014

10/22/2014

10/21/2014

10/16/2014

10/09/2014

10/06/2014

10/06/2014

10/03/2014

10/02/2014

09/30/2014

09/23/2014

09/23/2014

09/18/2014

09/17/2014

09/16/2014

09/15/2014

09/11/2014

09/11/2014

09/09/2014

09/04/2014

08/27/2014

08/26/2014

08/25/2014

08/04/2014

08/01/2014

07/29/2014

07/25/2014

07/24/2014

07/02/2014

06/26/2014

06/26/2014

06/25/2014

06/23/2014

06/18/2014

06/18/2014

06/05/2014

06/03/2014

05/20/2014

05/16/2014

05/14/2014

05/06/2014

04/24/2014

04/17/2014

04/11/2014

04/10/2014

04/04/2014

04/04/2014

04/03/2014

04/03/2014

04/01/2014

04/01/2014

03/21/2014

03/20/2014

03/20/2014

03/20/2014

03/20/2014

03/11/2014

03/07/2014

03/05/2014

02/25/2014

02/20/2014

02/18/2014

02/18/2014

02/14/2014

02/10/2014

02/10/2014

02/07/2014

02/06/2014

02/04/2014

01/29/2014

01/28/2014

01/28/2014

01/16/2014

02/12/2014

11/19/2013

11/14/2013

11/13/2013

11/05/2013

11/04/2013

11/01/2013

10/30/2013

10/25/2013

10/22/2013

10/21/2013

10/20/2013

10/20/2013

10/16/2013

10/16/2013

10/10/2013

10/02/2013

09/26/2013

09/25/2013

09/18/2013

09/10/2013

08/19/2013

08/08/2013

08/05/2013

08/02/2013

07/24/2013

07/24/2013

07/23/2013

07/22/2013

07/22/2013

07/22/2013

07/19/2013

07/18/2013

07/18/2013

07/09/2013

07/02/2013

06/25/2013

06/18/2013

06/17/2013

06/13/2013

06/12/2013

06/12/2013

06/12/2013

06/03/2013

05/21/2013

05/16/2013

05/16/2013

05/07/2013

04/30/2013

04/29/2013

04/29/2013

04/11/2013

04/04/2013

04/04/2013

04/01/2013

03/26/2013

03/25/2013

03/25/2013

03/22/2013

03/20/2013

03/19/2013

03/13/2013

03/13/2013

03/11/2013

03/07/2013

03/04/2013

03/04/2013

03/04/2013

02/27/2013

02/21/2013

02/20/2013

02/05/2013

01/31/2013

01/30/2013

01/24/2013

01/16/2013

01/03/2013

01/02/2013

12/10/2012

11/30/2012

11/21/2012

11/20/2012

11/20/2012

11/19/2012

11/19/2012

11/15/2012

11/15/2012

11/14/2012

11/13/2012

11/12/2012

11/12/2012

11/08/2012

11/02/2012

11/01/2012

10/17/2012

10/11/2012

09/24/2012

09/19/2012

09/12/2012

08/29/2012

08/03/2012

07/18/2012

07/17/2012

06/28/2012

06/19/2012

06/12/2012

06/01/2012

05/31/2012

05/31/2012

05/24/2012

05/21/2012

05/18/2012

05/14/2012

05/01/2012

04/30/2012

04/20/2012

04/18/2012

04/18/2012

04/13/2012

04/03/2012

04/02/2012

03/30/2012

03/28/2012

03/22/2012

03/22/2012

03/21/2012

03/21/2012

03/05/2012

02/13/2012

02/13/2012

02/09/2012

02/09/2012

01/27/2012

01/26/2012

01/19/2012

01/17/2012

01/11/2012

01/09/2012

01/04/2012

12/13/2012

09/12/2012

12/14/2011

12/09/2011

12/09/2011

12/08/2011

12/01/2011

12/01/2011

11/21/2011

11/17/2011

11/17/2011

11/16/2011

11/14/2011

11/14/2011

11/03/2011

11/02/2011

11/01/2011

10/27/2011

10/23/2011

10/19/2011

10/14/2011

10/12/2011

10/11/2011

10/05/2011

10/04/2011

09/29/2011

09/28/2011

09/22/2011

09/22/2011

09/13/2011

09/07/2011

09/01/2011

08/25/2011

08/24/2011

08/24/2011

08/19/2011

08/12/2011

08/11/2011

08/11/2011

08/05/2011

08/01/2011

08/01/2011

07/28/2011

07/21/2011

07/21/2011

07/19/2011

07/07/2011

07/06/2011

07/05/2011

06/29/2011

06/27/2011

06/26/2011

06/23/2011

06/20/2011

06/17/2011

06/15/2011

06/13/2011

06/11/2011

06/07/2011

06/03/2011

06/01/2011

05/26/2011

05/24/2011

05/23/2011

05/17/2011

05/17/2011

05/13/2011

05/12/2011

05/04/2011

04/26/2011

04/25/2011

04/21/2011

04/08/2011

04/01/2011

03/31/2011

03/31/2011

03/28/2011

03/21/2011

03/16/2011

03/16/2011

03/10/2011

03/08/2011

03/03/2011

02/28/2011

02/25/2011

02/24/2011

02/24/2011

02/22/2011

02/21/2011

02/18/2011

02/17/2011

02/16/2011

02/16/2011

02/15/2011

02/15/2011

02/14/2011

02/10/2011

02/08/2011

02/07/2011

01/31/2011

01/31/2011

01/31/2011

01/20/2011

01/19/2011

01/18/2011

01/14/2011

01/13/2011

01/11/2011

01/07/2011

01/06/2011

01/05/2011

01/05/2011

03/02/2011

12/28/2010

12/21/2010

12/21/2010

12/21/2010

12/17/2010

12/17/2010

12/15/2010

12/14/2010

12/14/2010

12/09/2010

12/09/2010

12/02/2010

11/19/2010

11/16/2010

11/15/2010

11/10/2010

10/27/2010

10/26/2010

10/15/2010

10/14/2010

10/12/2010

10/08/2010

10/07/2010

10/05/2010

10/01/2010

09/30/2010

09/24/2010

09/20/2010

09/18/2010

09/15/2010

09/01/2010

08/25/2010

08/24/2010

08/04/2010

08/03/2010

07/30/2010

07/29/2010

07/28/2010

07/26/2010

07/23/2010

07/23/2010

07/08/2010

07/06/2010

06/18/2010

06/17/2010

06/17/2010

06/10/2010

06/09/2010

06/02/2010

05/26/2010

05/25/2010

05/24/2010

05/14/2010

05/13/2010

05/12/2010

05/11/2010

05/06/2010

05/03/2010

04/28/2010

04/27/2010

04/26/2010

04/22/2010

04/22/2010

04/22/2010

04/20/2010

04/19/2010

04/16/2010

04/09/2010

04/05/2010

04/01/2010

03/31/2010

03/30/2010

03/25/2010

03/11/2010

03/10/2010

03/05/2010

03/01/2010

02/18/2010

02/17/2010

02/16/2010

02/11/2010

02/11/2010

02/05/2010

01/29/2010

01/28/2010

01/21/2010

01/14/2010

01/11/2010

02/10/2010

12/23/2009

12/22/2009

12/17/2009

12/04/2009

11/25/2009

11/17/2009

11/04/2009

11/03/2009

10/29/2009

10/27/2009

10/26/2009

10/19/2009

10/15/2009

10/15/2009

10/13/2009

10/09/2009

10/08/2009

10/05/2009

10/01/2009

09/30/2009

09/28/2009

09/27/2009

09/27/2009

09/27/2009

09/27/2009

08/19/2009

07/15/2009

07/01/2009

06/24/2009

06/18/2009

06/01/2009

05/20/2009

05/04/2009

04/20/2009

04/03/2009

03/18/2009

03/04/2009

02/18/2009

02/04/2009

01/15/2009

12/31/2008

12/17/2008

12/05/2008

11/24/2008

11/03/2008

10/21/2008

10/06/2008

09/22/2008

09/05/2008

08/06/2008

07/17/2008

07/02/2008

06/13/2008

06/02/2008

05/15/2008

05/07/2008

04/14/2008

04/04/2008

03/19/2008

03/06/2008

02/26/2008

02/20/2008

01/17/2008

12/28/2007

12/19/2007

12/07/2007

11/20/2007

10/31/2007

10/16/2007

10/03/2007

09/18/2007

08/24/2007

07/27/2007

06/19/2007

06/01/2007

05/16/2007

05/02/2007

04/17/2007

04/07/2007

03/15/2007

02/20/2007

01/31/2007

01/12/2007

12/28/2006

12/18/2006

11/28/2006

11/26/2006

11/03/2006

10/20/2006

09/29/2006

09/14/2006

08/31/2006

06/21/2006

05/31/2006

05/16/2006

04/21/2006

03/31/2006

03/17/2006

03/06/2006

02/16/2006

01/31/2006

07/28/2006

12/29/2005

12/19/2005

11/30/2005

11/18/2005

10/31/2005

10/21/2005

09/30/2005

09/19/2005

08/31/2005

06/30/2005

05/31/2005

05/13/2005

04/29/2005

04/15/2005

03/04/2005

02/18/2005

01/28/2005

01/07/2005

07/29/2005

12/20/2004

12/12/2004

12/03/2004

11/19/2004

11/05/2004

10/22/2004

10/08/2004

09/20/2004

08/10/2004

07/20/2004

06/30/2004

06/11/2004

06/01/2004

05/21/2004

04/30/2004

04/20/2004

03/18/2004

03/02/2004

02/13/2004

01/30/2004

01/19/2004

12/31/2003

11/26/2003

11/14/2003

10/24/2003

10/11/2003

09/23/2003

07/31/2003

07/20/2003

06/20/2003

06/05/2003

05/16/2003

04/18/2003

03/31/2003

03/21/2003

02/28/2003

02/13/2003

01/31/2003

12/13/2002

11/14/2002

11/14/2002

10/31/2002

10/11/2002

09/25/2002

08/30/2002

08/16/2002

08/02/2002

07/12/2002

06/22/2002

05/17/2002

04/30/2002

04/19/2002

03/26/2002

03/08/2002

02/18/2002

01/23/2002

01/10/2002

12/11/2001

11/30/2001

10/31/2001

10/10/2001

09/20/2001

08/31/2001

08/17/2001

08/01/2001

07/12/2001

06/28/2001

05/31/2001

05/11/2001

04/30/2001

03/30/2001

03/14/2001

02/13/2001

01/25/2001

01/10/2001

06/19/2001

12/22/2000

12/08/2000

11/27/2000

11/08/2000

10/23/2000

10/05/2000

09/22/2000

09/01/2000

08/18/2000

07/10/2000

06/19/2000

06/02/2000

05/15/2000

05/03/2000